My love for segmentation as the primary (only?) way of identify actionable insights is on display in pretty much every single blog post I write.

My love for segmentation as the primary (only?) way of identify actionable insights is on display in pretty much every single blog post I write.

I have said: All data in aggregate is "crap".

Because it is.

One of my earliest blog posts extolled the glorious virtues of segmentation:

Excellent Analytics Tip#2: Segment Absolutely Everything.

Many paid web analytics clickstream analytics tools, even today (!), don't allow you to do on the fly segmentation of all your data (not without asking you to change javascript script tags every time you need to segment something, or not without paying extra or paying for additional "data warehouse" solutions).

So it was with absolute delight that I wrote a detailed post about the release of Advanced Segmentation feature in Google Analytics in Oct 2008: Google Analytics Releases Advanced Segmentation: Now Be A Ninja!

Of course Yahoo! Web Analytics, the other wonderful free WA tool, had advanced segmentation from day one.

And as recently as two weeks ago I stressed the importance of effective segmentation as the cornerstone of the Web Analytics Measurement Framework.

[Update: Please read this post first in its entirety. Internalize it. Then when you are ready to get a jump start on advanced segmentation, download three super cool segments directly into your account from this post: 3 Advanced Web Analytics Visitor Segments: Non-Flirts, Social, Long Tail]

The Problem.

You can imagine then how absolutely heartbreaking it is for me to note that nearly all reporting that I see is data in aggregate.

All visits. Total revenue. Avg page views per visitors. Time on site. Overall customer satisfaction. And more. Tons of data "puking", all just aggregates.

The achingly tiny percent of time that the Analyst does segmentation it seems to stop at New vs. Returning Visitors! I have to admit I see that and I feel like throwing a tomato against the wall.

Yes new visitors and returning visitors are segments. But they are so lame that I dare you to find any insight worth, well, a tomato based on those two. You can't. Because new and returning are still two big indefinable globs!

Even if your business actually is tied to understanding the first and then subsequent visits by a person then you are far better off segmenting using Visitor Loyalty (in GA count of visits).

But I am getting off track (this whole non-segmentation business drives me bananas!).

Deep breath.

The Unbearable Lightness of Being.

Segmenting your data is key to your success and that of your company.

It is not very difficult to segment your data. Many tools include some default segments you can apply to any report you are looking at.

For example when you look at your revenue or goal performance it takes a trivial amount of effort to look at All Visits but add to that report the Paid Search Traffic and Non-Paid Search Traffic and get deeper insights.

You can tell your boss: We made 900k, and while you are obsessed with Paid Search please note that 850k of the revenue came from Organic and only $25k from Paid.

PS: Our business is in trouble because we are over-reliant on Search!

See what I mean, a bit better insights.

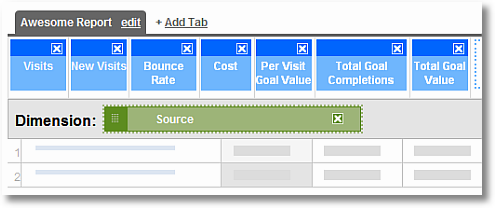

Among things in the above image I love analyzing Direct (to understand value of the free traffic), Visits with Conversions (to understand my BFF sources and pages and behavior), and Non-bounce Visits (to understand people who give me a chance to do business with them).

But true glory will only come from going beyond the default segments.

Because default segments are created to appeal to everyone / the lowest common denominator, and we all know that there is no such thing as "everyone".

You are unique. The top three things your business is working on are unique. The multi-channel strategy you are executing is unique. Your investment in tools vs people in your company is unique (you are 90/10 instead of 10/90!). You are struggling with your own unique challenges.

You have to have a segmentation strategy that is unique to you. And if you don't then your employment with the company needs to be re-evaluated. (Sorry.)

So how do you go about identifying unique segments for your business or non-profit?

Ask a lot of questions. Tap into the tribal knowledge. Force your leaders (ok HiPPO's) to help you define Business Objectives, Goals and Targets. [Key elements of the Web Analytics Measurement Framework.]

Let me tell you that without the above there is no hope. The first two will tell you what is important and currently prioritized. The third will tell you where to focus you analytical horsepower (based on actuals vs targets).

If you have O, G & T then it is time to select the segments to focus on, the micro-groups of data you'll focus on.

The Segmentation Selector Framework.

My humble recommendation is that as a best practice you should pick at least a couple of segments in each of these three categories:

1. Acquisition. 2. Behavior. 3. Outcomes.

You'll choose to focus on the micro group that is of value to you, and just to you, in each category. You'll apply those segments to web analytics reports where you hope to find insights (and if you choose the right segments you will!).

Let us look at each category I am recommending.

Segment Category #1: Acquisition.

Acquisition refers to the activity you undertake to attract people (or robots!) to your website.

This would include campaigns you run, like pay per click marketing (PPC), email, affiliate deals, display / banner ads, facebook marketing campaigns.

Acquisition also includes search engine optimization (SEO), because it is an activity on which you spend time and money.

Ask yourself this question: "Where is my company currently spending most amount of time and money acquiring traffic?"

Bam! There's the most important segment you will focus on.

Why? If you do your analysis right you can lower cost (by identifying and eliminating the losers!) and you can increase revenue (by identifying and investing where things are going well).

See the process I followed there?

- Ask the question to identify what's important / high priority for the business.

- Create a segment (and then micro segments) for that one thing.

- Apply on the relevant reports to measure performance using key performance indicators.

- Take action. It will have an impact!

Don't just log into Site Catalyst or WebTrends and go on a fishing expedition, or treat every single thing with equal importance.

Paid search. A specific group of keywords. Television campaigns. Email campaigns to prospective customers in Florida, New Mexico, Arizona and Utah. Coupon affiliates. "Social media campaigns" (context). Billboard ads on side on highways. Business cards handed out at trade shows.

All of the above are examples of acquisition strategies.

When you look at your web analytics data look at All Visits AND at least one of the above.

Two acquisition segments is normal.

If you make it three then choose one acquisition strategy that your company is experimenting with.

Say you have 1/10th of one person doing some tweeting or facebooking, :), then add that one segment to your top two. This will allow your management to look at what they are focused on and also one thing that sounds cool but they have no idea if it is actually worth it.

(Short term focus) Win – Win (Long term focus)

How To Apply Segments / Analyze Data.

The reports you'll apply your acquisition segment to will depend on the Key Performance Indicators you have chosen. But a typical set of metrics you'll evaluate will hopefully represent a spectrum of success, like for example. . .

The effort will be to try and understand if for our acquisition segment (say all my brand keywords or for email campaigns to increase sales of the most expensive products). . . .

- How many visits did we get (to get context)

- Of those how many were new visits (if that is a focus)

- How many could we get to give us one pathetic click (bounce rate!)

- What was the cost of acquisition (if you can get total cost give yourself a gold star)

- What value could we extract at a per visit level

- How many people could we get to convert (replace total goal completions with conversion rate if you want)

- What was the total value added to our business or non-profit

As you look at your acquisition segments in context of all visits you can quickly see how you can start to find insights faster. Don't focus specifically on the metrics I have used above but rather the thought process behind their selection.

This is not the end of your journey but it is a darn good start!

[If you have pop the CD at the back into your computer. In dashboard examples look for Stratigent_Sample_Dashboard.xls, via my friend Bill Bruno at Stratigent. It has an excellent example of segmented acquisition display, you can immediately steal it for your company!]

Segment Category #2: Behavior.

Behavior refers to the activity people are undertaking on your website.

When people show up, what is it that they are doing? Is there anything discernable / important in their behavior that is adding value to your online existence? Or, the flip side, what do we want people do to on our site, and is anyone exhibiting that behavior?

Even people who sometimes have segment their web analytics data often forget to segment by online behavior.

Many, but not all, behavior segments fall into these two buckets: People who see x pages. People who do y things.

Here are some specific examples (all of which you can create in Yahoo! Web Analytics or Google Analytics in a few seconds without having to pay anything extra for vars and slots or having to update your javascript tag or having to buy an add-on, you can also apply them to all your data including all your historical data).

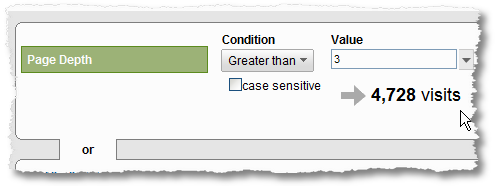

Visits with more than three page views. . .

This can be so valuable on content only websites (more page views more impressions of irrelevant display ads!) or even on ecommerce websites (more pages views the deeper you sink your hook into the visitor, engagement baby!).

Where do these people come from? Do they buy a lot? A little? Do they write reviews? Did we acquire them or did they just show up? If they see so many pages what type of content are they interested in (politics? naked pictures? sports?)?

So on and so forth. Segmenting one behavior, understanding its value.

Similarly another could be focusing on people how add to cart and then abandon the site.

Or people who enter the site on the home page and their behavior. . .

Or all those who did not enter the site via the home page!

Or people who use the site's product comparison chart or car configurator or, my fav, internal site search. Vs. those that don't.

Or people whose Days to Purchase (/Transaction) are 5 vs for those for whom the Days to Purchase is 1. . .

Or, cuter, those whose last visit to our website was 100, or whatever, days ago. Why? And what do they want?

Or people who visited the site more than 9 times (!) during the current time period. . .

Where are these sweet delicious people coming from? (Note: To a blog updated only twice a month!) What do they read? What do they buy? What can we learn from them and do more of?

Those are the types of questions you'll answer from your behavioral segments.

The more you understand what people are doing on your site, the more likely it is that you'll stop the silliness on your site (kill content, redo navigation, make cross sells better, eliminate 80% of the ads, learn to live with 19 days to conversion, don't sell too hard, and so much more).

It is also likely (I want to say guaranteed) that you'll find the delta between what you want to have happen and what your customers want. You'll choose to make happier customers, who in turn, in the naughtiest way possible, will make you happy.

And it all stars with being able to identify and focus on the right behavior segments.

Pick at least two.

But I have to admit in this segment category I truly "play" with the data a lot because it is so hard to know what the right segments are, because visitor behavior is such a complicated thing (they are constantly trying to mess with us Analysts!).

It is only after experimentation (a lot) that I end up with something sweet.

Segment Category #3: Outcomes.

Outcomes are site activities that add value to you (business/non-profit).

I find that here the problem is less that the Analysis Ninjas don't segment, rather it is that they are incredibly unimaginative.

But first what is it?

Segments with outcomes are people or visits where you get a order (at an ecommerce website) or you get a lead (at Organizing for America).

Those two are obvious right?

Segment out people who delivered those two outcomes. Give them a warm hug and a kiss. Now go figure out what makes them unique when compared to everyone else who showed up at your website, all those other people who you worked so hard to impress but failed to.

Take the insights and do more of what works for this group.

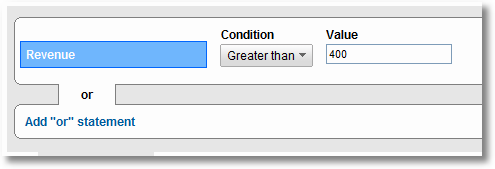

Or segment out everyone whose order size is 50% more than the average order size. . .

These are your "whales", people who spend a lot of money with you. Don't you want to get to know them a lot better? : )

But there is more.

Remember macro AND micro conversions!

No one is going to sleep with you on the first date. (Ok maybe a few will!)

So focus on micro conversions that lead up to a macro conversion… like people playing a product video (or on content site watching five videos!). . .

![]()

Or adding a product to their Wish List.

Or signing up to show up for a protest for your ultra liberal policies!

Or apply for a trial, or download a trial product.

You can also focus on micro conversions that all by themselves are of value to you, even if not as much as the macro conversion.

For example submitting a job application.

Or signing up for a RSS feed.

Or clicking on a link to go to a different site you want them to go to (like clicking on the amazon link to go buy my book – great outcome :)).

Of course if you are really really good you'll also segment my absolute favorite metric in the whole wide world: Task Completion Rate. It is the ultimate measure of outcome (from your customer's perspective).

Net, net. . . it is absolutely critical that you segment your data by the key outcomes important to your business. Not just because your site exists to add economic value, but also because I cannot think of another way you can earn the love of your boss or get promoted.

By understanding what it is about people who deliver outcomes you can understand what to do with all those that don't convert.

Outcomes. Outcomes. Outcomes!

Pick at least two.

If you pick three or four that is ok.

If you pick nine it might be a signal you don't know what you are doing (and you want to corner your boss in a non-HR-violation manner and ask her to help you focus on the most important).

In Summary.

Segment or die.

It is as simple as that.

The next time you start to do true analysis of your data I hope you have your minimum six segments in hand (two for each category). If you do you'll find that web analytics, this world full of web metrics and what not, suddenly becomes a lot more interesting (and you no longer feel like jumping out of your office window in frustration!).

Love, money and glory await you.

Not to mention how proud I'll be of you when I see your analysis. ; )

Ok now your turn.

Are you a segmentation God? What are some of your favorite segments? Have you used this three category framework in the past to find segments? Do you think they'll work in real life? In the context of segments what do you think is missing from this blog post? What did I overlook / not stress enough?

What's your excuse for not leveraging segmentation? (Best answer to this question win's a copy of Web Analytics 2.0!)

Please share your thoughts / wisdom / critique / guidance.

Thanks.

PS:

Couple other related posts you might find interesting:

- Excellent Analytics Tip#2: Segment Absolutely Everything

- Google Analytics Releases Advanced Segmentation: Now Be A Ninja!

- Excellent Analytics Tip#4: Make Your Analysis/Reports "Connectable"

- "Dear Avinash": Be Awesome At Comparing KPI Trends Over Time

- 10 Fundamental Web Analytics Truths: Embrace 'Em & Win Big

Via

Via

"Many paid web analytics clickstream analytics tools, even today (!), don't allow you to do on the fly segmentation of all your data (not without asking you to change javascript script tags every time you need to segment something, or not without paying extra or paying for additional "data warehouse" solutions)."

It is unfortunately so true and I don't get it. To be honest, when you see what Google Analytics can do (or YWA), I don't understand why paid vendors don't come with something similar.

You can do this with other tools but it requires extra efforts (like creating specific reports for each segment you want to analyse), extra resources (you end up with tens of different reports and profiles) or extra costs (need to buy the warehouse suite or live-segmentation add-on).

When you think that Web Analytics tools primary purpose should be to make smart decisions easier and to work more efficiently – it lost me to see it is not the case when it comes to live-on-the-fly-adhoc segmentation. Especially when there are products that can do this for free.

Go figure…

But some paid vendors may lost more in the end if they don't come up with something that can match GA / YWA offering in that area.

Michael

Thanks for simplifying Avinash! Segment or Die! It's simple.

For me, whether Google Analytics users are working with Advanced Segments is a basic competence / education test.

It's like here in the UK where the car drivers those with "L" learner plates on their cars – they're not yet safe to drive on their own and urgently need to be shown the controls. Not meaning to be patronising, not sure why, maybe the "Advanced Segments" button is too scary. Would be interest to AB test that scent trail.

To help explain segmentation options for Google Analytics users I have outlined 10 segments to review : http://www.smartinsights.com/blog/web-analytics/google-analytics-web-analytics/segmenting-google-analytics/ – these are in order of importance/value.

As per usual I have been overanalytical and your 3 categories cover my 10 I think. But hope it's helpful.

One tip that you don't mention here, I think, but have elsewhere, is the value in setting up custom segments for brand/non brand for paid and natural traffic. You can't measure your investment in PPC and SEO without isolating the relatively easy brand traffic.

Thank you for this insightful post. The three category framework you have outlined has now put a semblance of structure around how I have being working without consciously being aware of it!

To push the segmentation analysis further, I find it useful to create sub-segments once the 'basic' three category segments have been built.

So, if I have an acquisition segment such as 35-39 year old females that have come to a site via a facebook ad (the basic acquisition segment), I will then create sub-segments that incorporate behavioral or outcome characteristics. For example – whether they posted a comment or downloaded some free content thus giving me a sub-segment that is 35-39 females from Facebook who downloaded (or didn't download) the sample book. I will then look at outcomes for these sub-segments such as sales revenue to see whether there is further insight that can be generated.

You do simplify the segmentation areas in a way that makes it much easier to understand. Nothing makes me feel like I've been spinning my wheels more and gets me on track. I love it when you do that. (well worth the price of admission :)

However I'm not clear on the differences between behavior and outcome segmentation. It seems that on an ecommerce/lead generating website that behavior is a sub segment of outcomes. After all, isn't that how behavior is evaluated, by outcomes? Perhaps acquisition is evaluated the same way for that matter? Could it be that it a question of the focus of the analysis?

Hi Andy –

Good question! I would say "Behavior" is the action of the customers in the middle of "processes" lead to the desirable outcome. So behavior and outcomes are closely related, but different. Let's say if desirable outcome is getting A+, behavior would be studying, reading, or impressing professors etc…

Hi Avinash,

Great post as always, and I wanted to chime in with a few comments:

1) Segmentation+Outcomes gets your analysis taken seriously by decisionmakers. One of the key issues I hear from many analysts is that they don't get taken seriously when they take their great work to the corner office. A well executed segmentation report goes a long way towards getting you the first bit of buy-in from your local HiPPO. As an example, we have a number of clients in the catalog space who are all very pleased by their eCommerce conversion rates; at least they are until we build a segment called "catalog visits", another one called "web only" visits, and show the difference in conversion rates….

2)Don't hate New vs Returning analysis! While showing the high level metrics on new and returning visits isn't all that valuable, it provides an awesome initial focus for getting started with both segmentation and optimization. We all know that new visitors are going to convert at a lower rate than returning, but by really understanding this visitor type (segmenting the segment?) you can begin to create a better new visitor experience that will create more conversions.

After analyzing all aspects of New Visitors for one of our pure play eCommerce clients (traffic sources, keywords, landing pages, Time on Site etc.), we were able to determine that New Visitors arriving from commoditized, non-branded terms onto a product page were both 30% of all visits and converted at under .5%. This understanding allowed us to help the client significantly grow sales by creating the right experience.

I wrote a whitepaper for a personalization vendor a few years ago (when segmentation in GA was still a lovely dream…) on understanding and speaking to this segment, link is: http://www.sitebrand.com/download.php?type=wp&file=Sitebrand_Whitepaper_First_Time_Visitor.pdf

Thanks for all the great work you do,

Jim

Avinash,

I'll take off my "Ultimate Omniture Fanboy" hat, albeit briefly, to add that those folks using GA should seriously consider ShufflePoint as their access to the data–you bypass the GA GUI and port the data straight into Excel. It's an approximation of Oracle Report Builder (drool-worthily wonderful tool. OK, fanboy hat back on) for GA with exceptional support for GA Segments. I think you might even be able to build segments within the latest release of ShufflePoint.

Cheers,

j

Is it "Segment or Die" or "Segmentation Rocks"?

Either makes your point that segmenting your data is the only true path to web analytics enlightenment.

This very day I was working on a very interesting Advanced Segment in Google Analytics that I'd like to share with you and your readers.

We had several clients inquire about Google's so-called "MayDay Update" that is rumored to be reducing long-tail keyword traffic by up to 50%, as reported by some well-known webmasters.

Our SEO Leader approached me about being able to isolate long-tail keyword traffic in Google Analytics for clients and I thought it might be possible using Regular Expressions, and I was right!

If you are not familiar with Regular Expressions you can find a tutorial here: http://www.google.com/support/conversionuniversity/bin/static.py?hl=en&page=iq_learning_center.cs.

I created an Advanced Segment using the following regular expressions to isolate long-tail keywords (3 to 5 words long). I used the Regular Expression Matches Exactly qualifier then I input these values with "OR" statements between, to capture 3 and 4 and 5 word long-tail keywords:

^\w*\s\w*\s\w*$ – for three-word long-tail keywords

^\w*\s\w*\s\w*\s\w*$ – for four-word long-tail keywords

^\w*\s\w*\s\w*\s\w*\s\w*$ – for five-word long-tail keywords

So, as you touch on the vitally important topic of segmentation I thought I would share my own latest adventure into this fantastically rewarding area of web analytics.

Another great post Avinash! Keep 'em coming!

Wow! What a detailed and insightful post.

I just started a new job and in my old job I was able to dabble in analytics. But, as this post clearly shows – there is no DABBLING. You have to be committed to the data and know how to use it.

Thankfully there are a lot more people invested and committed to analytics here. I am really excited to dive in to the world of analytics again! Thanks!!!

I'm with Jim Cain on New vs Returning segments – you can derive insight, for example:

1. Which content is more popular with returning / new visitors?

2. Which navigation options more popular for each – I find this the most useful feature of the Dimensionator bookmarklet tool: http://www.analyticspros.com/blog/googleanalytics/93-dimensionator-google-analytics-dimensions.html – you can use Second Page viewed to gain an idea of what are primary paths or preference for nav options.

3. How do traffic source, keywords, value generated vary for new and returning.

Michael: I believe the paid vendors know that they are very weak in advanced segmentation in their clickstream web analytics tools. My hypothesis is that that feature is being used by them as

1. a way to get you to pay more after you pay their entry price (on which they are likely losing money)

2. a way to get you to upgrade to the more expensive products (to create profitability for them)

They do need to make money, so the fact that they won't improve their clickstream product is understandable. But I do wish that they would try to make money by providing more powerful features rather than making money on advanced segmentation feature.

Dr. Chaffey: In the post I was hoping to spark ideas for the "macro segments" (big buckets). Your suggestions are wonderful "micro segments" of the acquisition (search) strategy.

Lenny: You are 100% right. Once you identify your valuable macro segments, you'll quickly drill down (to the point of diminishing returns! :)) to crate micro segments that will really yield specific insights. Bravo!

Andrew: If I were to simplify my reason for keeping those two separate then I would say that most people who come to your site will never deliver an Outcome (remember only 2% will convert).

So behavior is all about analyzing everyone who is on the site and what can be learned about their behavior.

Analyzing Outcomes (look at the specific examples in the post) is all about analyzing the 2% with a very specific focus on you (the company).

Hope this clarification helps.

Jim: Loved your comment. Thank you!

I have to admit that if I see New and Returning visitors (and nothing else, or not much else) then I instantly classify it as the work of an amateur. Note: amateur is not a dirty word!

If you do new and returning, and not much else, it means you are taking the easy way out. Both in the effort you are putting in and for the insights you'll find (negligible, even accounting for Dr. Chaffey's second comment :)).

Segmentation to me is the art of moving from a "glob" to specific, and new and returning segments barely do that. You are still left with two segments you understand very little about.

Here is a metaphor (I love 'em!): Your have a pair of sunglasses but the lenses are coated with black paint and covered in dust. By doing new and returning you are blowing the dust off. You are better off, but not by much! :)

Hence my suggested alternative, use Visitor Loyalty. At least you care create better hypothesis and the segments will be more focused and yield some insights.

Yes, yes, yes I am totally biased on this particular issue. : )

PS: My humble experience does not bear out that new visitors convert at a lower rate, or higher. It varies so much. But I am not disagreeing with your specific example of the ecommerce site, and it is clear that you followed the right process to get to actionable insights.

Anthony: This is awesome!

An excellent use of advanced segmentation to answer a very specific question raised by the business. Thanks for sharing it with us.

-Avinash

To build off of Lenny's strategy, I really like the idea of running multiple Facebook ads – all identical, but targeting different demographics. Then build a custom URL that categorizes the traffic for analytics and use that as the destination URL. Might get some interesting insight from that.

Love the advanced segments Anthony put together for the May Day update. Well done!

One of my most thorough GA profiles is for a consumer electronics company. They have stores in the Northeast but the majority of their business happens online. I had several meetings with them before beginning any analytics work that centered around identifying potential segments that were most important to them. This included both traffic source (organic, ppc, affiliate, etc. etc.) and the product/category they were viewing on the site (broken apart by category and/or price range). What I ended up with was a very long list of advanced segments. For example, I had it to the point where we could track purchases between $250-500 coming from affiliate traffic that was located within the tri-state region (where customers have the option to pick up in store) – all within about two clicks!

The biggest lesson I learned from that project is the value in sitting down and hearing from the horse's mouth (err….HiPPO's mouth) what breakdowns are important and relevant to their business. It can take different levels of prodding and brainstorming, but it gives you an excellent starting point for diving deep into the data.

@Anthony C

This is the article he was talking about if anyone was interested:

ttp://www.seroundtable.com/archives/022128.html.

Referring to the "May Day" update in the Google index. The segment on long tail KWs is definitely interesting to look at on both the SEO and Web analytics POV. So for people working at Fortune 500s with an extensive CMS database or sites with a lot of social media links, this segment will be of great interest to you.

The regular expression for the segment is the 5th or 6th comment down I believe.

Custom variables… if you had two or three that could add for the purposes of segmentation, what would you pick? (Let me guess.. the answer "depends on your site.")

Thanks for another inspiring post, Avinash!

Chris: You are absolutely right on the consultation part, I have always found it to be of value to spend time with the HiPPO's and understand the business context and priorities before going to take the data shower. :)

Also great example of the electronics company!

Josh: It does depend! :)

The one I am using on this blog is Commentators. I fire off a CV if you submit a comment and then I segment those visitors (that's the scope I use for the CV's) and analyze their behavior separately.

In my case the custom variable is tied to a desired outcome, I find that that is typically a great way to select 'em.

-Avinash.

Great post, love having this set out in a framework – helps explaining to others how/what/why needs to be done to understand contributors and detractors to performance.

I constantly seem to be debating the case for disaggregated (by channel/tactic) vs. aggregated data. Guess it is our theme song!

Keep pointing at total visitors etc and saying "And now what? What are you looking at? What should we be looking at next? What do we need to understand what is happening?"

The answer is always segments…always

Thanks, Rob.

Segmentation my favorite Topic.

Great post Avinash!

Other than Google Analytics for segmentation, Omniture Insight is a best tool to do segmentation. We can create/define metrics, can do unlimited segmentation, create segments on the fly. A lot of interesting stuff!

Some amount of risk is always associated with “segmentation”. If one doesn’t know the exact way to create the segments then it can screw your entire analysis. In Omniture Insight there are number of ways to create a segment and not all the segments will l give you the same set of data out. One must know the exact way to build a segment or sometimes it may also give you different results. One need to follow the business rules to build the segments and present your data.

Thanks for this excellent topic.

I would suggest two situations, where segmentation is not the first choice (although certainly would provide further insights in a second step):

1. Identifying global incidents which tend to influence not only a specific site/traffic source but more or less all. Such can be: holiday, disasters, wheather or changes in googles ranking algorithm (although this could be obviously considered as the organic traffic segment…)

2. Another prerequisite is, that the analysed site has a statistically significant amount of users. Otherwise segmentation perhaps might suggest the falsified insights. In small projects I use almost no segmentation till the aggregated metrics indicate a sensible amount of users. Nevertheless the aggregated metrics indicate whether I'm on the right way or not.

Thanks for always great and entertaining insights!

#12 that is brilliant, So stealing that.

The stats tell me most of my visitors convert after only 1 visit. My new and returning doesn't tell me anything of value, as most people browse during office hours, consult with their spouse, and book their holiday on the home computer between 7 pm and 11 pm.

However, I just got tracking of microconversions (printer friendly page, send-a-friend, call-me-back, newsletter) to work, and the best thing is seeing how they behave differently across the mediums.

My branded / direct visitors do print a page more often, showing engagement, which referral / affiliate visitors don't. However, they subscribe to the newsletter more often. Newsletter subscribers convert +150%.

Look ma, I got's me some customer insight!

Suchet: I agree with you on Omniture Insight, it is a wonderful tool (and should be sold bundled with every single Site Catalyst sale!).

To your second point…. tools are just tools. If you give me a hammer I can't build a house. I simply do not possess the expertise, even if the hammer is nuclear powered and artificially intelligent!

It is the reason I have constantly stressed the 10/90 rule, it is the investment in smart people that is the secret to success.

Stephan: You are right that in some cases if the event is big enough then the impact will filter through to even your aggregate data. Say the Icelandic volcano on travel.

My gut instinct though is that it won't happen often enough (thank god!) and for most businesses most impactful things will be invisible in aggregate.

For smaller sites it is right that you won't find deeper insights because by the time you segment your Google/Bing traffic that might just be four people. While in that case some insights could come from aggregate data, I recommend focusing on how to get more traffic! Maybe switch to qualitative data to see what is working.

Thanks for the great points, made me think!

Sabine: Best line ever: Look ma, I got's me some customer insight!

: )

Avinash.

I don't leverage segmentation because I work for a .gov and we can't drop cookies due to privacy constraints, so I struggle to figure out how the site is being used (I know pageloads and downloads, much not much else). Any recommendations for working with "the man?"

Even though I can't always apply what I read, I still think your blog is fantastic!

Gah! I'd be dead without segmentation.

I have everything segmented into these sub sets:

Product Category Based on Search Term

– Those With Leads/Conversions

– Those without Leads/Conversions

– Those with 13+ Pageviews (Our magic number for having a good chance tho create a Lead)

– Those With Less than 13 PVs

Referral Traffic

(Same as Above)

Those that Viewed our Quote Form

Those That Viewed the Contact Us Page

Then, lastly, and almost most importantly:

Searches with "Custom" in the term

We're a custom products manufacturer. You'd be amazed (well, maybe you wouldn't) how much better we convert visitors to leads with that magic keyword in the searchstring.

John: While you are 100% correct that .gov sites won't use cookies, and hence limit segmentation, you'll be surprised to learn that that only rules out maybe 5% of the segmentation options for you.

Primarily what you won't be able to do are Unique Visitor based segmentation. But you'll still be able to do 99% of what is in this post (pages and sources and goals and outcomes and time and…. lots!).

Check out this primer on cookies, there is a section where I outline how much you can't track if you don't enable cookies:

A Primer On Web Analytics Visitor Tracking Cookies

And here is my post on how I would track government websites:

Web Analytics Success Measurement For Government Websites

Hope this helps.

And… Go Government!! : )

Kevin: Thanks for sharing the very specific segments, I am positive readers of the blog will find it to be of value.

Avinash.

My excuse is lack of consistency. I begin doing something, then I find something else more interesting, then suddenly I change the look of the site… which last time involved forgetting to insert the tracking code in the theme and I was devastated to see the updated pages of the site performing like a disaster when compared with what I thought was an outdated and horrible design. Then, just as I was about to revert to the old theme, I discovered the missing tracking code (which explained how I got comments on pages that didn't get visits…). Lets just say an analysis tangle of a magnitude that makes chaos look pretty. Just beginning to see new data that has nothing realistic to compare with in the past.

The excuse is sheer incompetence combined with a new baby and 'fifty things to do' life. Does it get the cake?

I am beginning to schedule time for different things on the site, where I let go of everything other than the baby and simply focus on the one thing that is in front of me.

This is scheduled time for reading your blog in the hope that I get some insight into prioritizing what to do first.

I'm pretty ashamed to say that I have a site with over 3000 pages which is sinking like a stone in search results because of my inability to do something coherent with it. I'm down to an all time low of below 100 visits a day. And that is painful for me, because its a labour of love – a one woman creation – right from the time I learned html and created awful, heavy and garish pages with content in flash (:o) to the learning journey to a place where it can validate xhtml strict and regular readers write to tell me how much they love it and join our initiatives. I am currently getting nightmares about how one day I will find the site dropped from search engines and readers asking "Vidyut who?" because I just didn't focus on something I should have.

Just sharing this, because I think most of this arises from me not bothering to consult analytics when I did find a little time to put into the place. Repairs are a long and painful process.

Vidyut

Great post, Avinash.

I completely agree that segmentation is pretty much the only way to develop actionable insights from large data sets, and simply relying on aggregate data is useless.

However, aggregate data has some use. For example, aggregate data is useful to understand the segment in context. To what degree does the segment make up and effect the aggregate?

Overall revenue is an aggregate metric that we care about. It's an outcome that we can't really manage directly ("We need more sales!" "OK, somebody pull the sales lever!"), but it's definitely useful to know that a particular customer segment makes up 34% of visitors and 75% of sales, for example.

This type of context is helpful in determining where we want to apply scare resources to improve overall business.

Nonetheless, thoughtfully determined segmentation is clearly the way to separate the important nuggets from the ocean of data we swim in. Thanks for posting some excellent examples of how to get there.

@Anthony, your post reminded me of this little gem: http://www.seomoz.org/blog/charting-unique-keyphrases-using-advanced-segments

on segmenting search traffic by brand name, head terms, and other.

This is the best guide on segmentation on Analytics that I've read so far, thanks so much.

I'm a new reader and will definitely stick around, as in "recent posts" I can see lots of good sounding titles!

Avinash, I was trying to catch up on a lot of reading this weekend and as I was reading through the first section of this post I was like OK I am going to play Simon Cowell and give Avinash some critical feedback on the readability of the post this time, but it came together and was very readable and valuable as always, so I guess I am being more like Paula Abdul now and saying great post keep it coming. Also, so stoked to see such great comments adding even more value to your content.

I see that nobody is tackling the why aren't we segmenting question publicly? I don't expect to win a book for this lame answer, but here is the reality of our situation that we are working hard to fix as quickly as possible:

(1) Too many tools, not enough value. We just completed an audit of our site and we have over 70 tools on our site between 3rd party solutions and proprietary tools that we've written and we have a team of less then 6 that either use the tools or have ownership for the tools. I am on a crusade to eliminate tools we can't effectively support.

(2) Complacency with data without insight. I can't tell you how many management meetings I sit in where people puke data that doesn't really have any meaningful insight and then everyone nods their head and we move on. Believe me, we are all hard working people but I think the majority of the problem is the lack of wisdom to understand what data is, how to use data, how to do analysis and a model for continual improvement. The concepts are actually not that difficult, even for someone with my intellect to wrap my head around. Instead, we get back on the treadmill and keep trying the same things again and again and again and wonder why it's not getting any better.

The good news is that through the work of people like you, Stephane Hamel, Jon Miller with Gemba Research and others we are becoming enlightened.

Thanks and keep up the good work.

Shilo

I love this post Avinash. Thank you!

I can understand the confusion around behavior versus outcome. It's almost like behavior can also be a micro-conversion in some cases. Watching a video, for example, is a behavior and a micro-conversion point if it turns out that folks who purchase usually watch the video.

A macro-conversion like buying something will always be an outcome.

Have I got this right?

Steve: You are right that a behavior can very well be a micro-conversion. Not just on ecommerce websites, as you describe, but especially for non-ecommerce websites.

A micro-conversion is anything that delivers either a short term or long term value to the business. It could be buying, but it would also be non-buying behavior as well.

Avinash.

I think google analytics is a very good tool and as a free tool is very good for a domain with not a lot of traffic and visitors. You can see keywords people use, how long and on what page they spend there time on and how they got there.

Segmenting is new thing for me so will have to look into this, but thanks for this info, very helpful.

Hey Avinash.. that's a awesome posting as I was expecting.

I had a quick question about the advance segment. I manage 32 different clients and once I save the new custom segment it gets applied across all the profiles.

Is there a way you can differentiate the settings according to the profile?

Josh – when you create an advanced segment, click >More Options, then click the second radial button. This lets you add the Advanced Segments to specific profiles.

Hi Avinash,

Do you know of a way to plot rows in google analytics, where you can remove the top line "Total" from the graph so you can actually see the plotted rows? The total is always so large in scale against any one of the single plotted rows, that it makes plotting rows useless, visually. I have been pulling the data down into a spreadsheet and creating my own graphs, but that is time consuming, especially when I am trying to decide if something is even worth attention. It makes high level reporting and evaluation extremely difficult. Am I overlooking something or is there a trick to removing "total" from the graphs?

Thanks!

BDoubleU: I try to just skip GA in these cases, mostly because when we are trying to do unique things that apply to just a few scenarios, it is best to go with something specialized.

There are a whole lot of Google Analytics Apps, free or paid, you can use to do some rocking visualizations.

Next analytics is pretty cool. You'll probably have some fun with GA Data Grabber for Excel.

There are literally tons for you to scan through in the Business Intelligence section and the Reporting Tools section.

-Avinash.

Avinash,

You might have addressed this already, but I am struggling in GA to segments some adwords performance by campaign name.

Is it impossible to view 'Clicks' when segmented? Visits show a count, but clicks report 0.

Thoughts?

Sean: You are right. In Google Analytics when you have a report with AdWords data in it, like Clicks, you are unable to segment it.

This has to do with nuances of what comes over from AdWords. Perhaps the GA team will work closely with the AdWords team to eliminate this issue in the future.

Avinash.

Avinash, First let me say thank you for this site. I am learning so much. It's a steep learning curve, but you are making it easier to navigate.

I was hoping you could update the link to the 4Q video, which is currently returning a 404.

All the best,

Tyler

Hi Avinash,

Google now has hidden its data, we know less data today, how to make the most of google analytics today?

Thanks

Ibu: Please see this post, it provides a cluster of strategies you can use to do keyword analysis:

~ Search: Not Provided: What Remains, Keyword Data Options, the Future

-Avinash.

Thanks for Posting Avinash. As usual, you have highlighted the importance of not stopping at aggregate data. This is a reminder for me to go a little deeper. I plan to further segment my acquisition data for better understanding of where my traffic is coming from. I know this will be extremely effective. thanks again.

This is the very great post indeed.

I am a new job in a SEO Company, i am a learner at this point of time. Your post has helped me a lot learning Analytics.

Thanks Avinash.

What an awesome article about segmentation in web analytics.

I have a question Web Analytics in large e-trade company, Who must be responsible for web analytics: Is it ok for digital marketer to know basic of web analytics and leave analysis and reporting to web analysis expert?

We have 200.000 customers and doing multi-channel marketing with small team and sometimes it's really hard to spend time for making segment, filter etc..

Thanks…

Burkay: Over a long period of time, you want to bring almost everything in-house. Except the small (but an incredibly important bit) that will be at the very bleeding edge.

In your case, it might be an evolution to get to that point – and that is quite fine. Please checkout a post where I share the four stages of out-sourcing things (either to an outside agency or an outside team internally in your company) and how to decide to slowly move things inside the company (or into your team). Here's the post: Web Analysis: In-house or Out-sourced or Something Else?

All the best!

Avinash.

You could not be more right when you talk about failure of organizations to segment out their data.

I worked on the website of a Fortune 100 company. When I got there and asked to see all of the available web analytics reports, every report was like "Total Clicks", "Bounce Rate", "Visits". There was not a single segment anywhere. And there were people working full time on producing this data!

Moral of the story is not assuming anyone, no matter how big the company is or what their position is ever reads this blog. It would make life too simple.

Thank you Avinash.

Hello Avinash,

This is the second one of your articles that I have read now and again you have impressed me and left me with allot to think about.

Your blog is brilliant, please keep up the good work.

Thanks for another interesting post!

It is a good starting point for our discussion in our agency!

Los segmentos también aportan contexto. Muchas veces nos quedamos en el dato "a pelo", sin contextualizarlo, sin aplicar segmentos que pueden aportar major valor al dato. Fuentes de tráfico, dispositivos, tipología de páginas, tipos de usuarios… Avinash tiene un publish muy total con metodología sobre cómo elegir los segmentos relevantes.

Pretty old article but that doesn't make it any less relevant. Great stuff. Personally I particularly like "whales" segments and segments that compare social media campaigns.

I am a first time learner and the insight here are really great.

Thanks Avinash

Very impressed with the article.

It has a high degree of the details about the subject which one must know.

Amazing information.

Hello Avinash,

Seeking your guidance. Organizations have their segmentation and in paid search we typically see the small size organizations reaching through paid search and fill forms. There seems to be a pattern that shows small size organizations are active in paid search than mid-size and large-size organizations.

What is the relative position or importance of search for different size organizations? or to put it differently as organization size increases, where does search play a role?

Seeking your insights. Thanks in advance.

Ramanathan: The role of Search does not change. It is still the strongest "expressed intent" platform and every organization of any size should take advantage of it to the maximal point.

What I do notice that will change is that larger organizations complement Search with other marketing strategies that have less "expressed intent". These strategies tend to be more expensive comparatively, but they are still profitable. Managing a portfolio effectively is harder for a small or medium sized organizations (people, budget etc.).

Avinash.